Glendale Ohio Income Tax . Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. The state has four tax rates: Ohio’s 2023 income tax latest updates. Ohio state income tax brackets depend on taxable income and residency status. Ohio is currently in conformity with federal law for tax purposes as. Glendale is one of only four communities in hamilton county that does not have an income tax. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. 0%, 2.75%, 3.68% and 3.75%. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Learn who must file an ohio annual income tax return from the ohio department of taxation. Known for its quiet, peaceful living,. The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay.

from tessimahala.pages.dev

Ohio’s 2023 income tax latest updates. Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. Known for its quiet, peaceful living,. The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. Glendale is one of only four communities in hamilton county that does not have an income tax. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. The state has four tax rates: Learn who must file an ohio annual income tax return from the ohio department of taxation. 0%, 2.75%, 3.68% and 3.75%. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view.

Ohio Tax Day 2024 Efile Clio Melody

Glendale Ohio Income Tax Glendale is one of only four communities in hamilton county that does not have an income tax. Ohio state income tax brackets depend on taxable income and residency status. Ohio is currently in conformity with federal law for tax purposes as. The state has four tax rates: Ohio’s 2023 income tax latest updates. 0%, 2.75%, 3.68% and 3.75%. Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. Glendale is one of only four communities in hamilton county that does not have an income tax. Known for its quiet, peaceful living,. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Learn who must file an ohio annual income tax return from the ohio department of taxation. The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view.

From townmapsusa.com

Map of Glendale, OH, Ohio Glendale Ohio Income Tax File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Ohio state income tax brackets depend on taxable income and residency status. 0%, 2.75%, 3.68% and 3.75%. Ohio’s 2023 income tax latest updates. The state has four tax rates: Use the finder to find local tax rates for sales and use tax,. Glendale Ohio Income Tax.

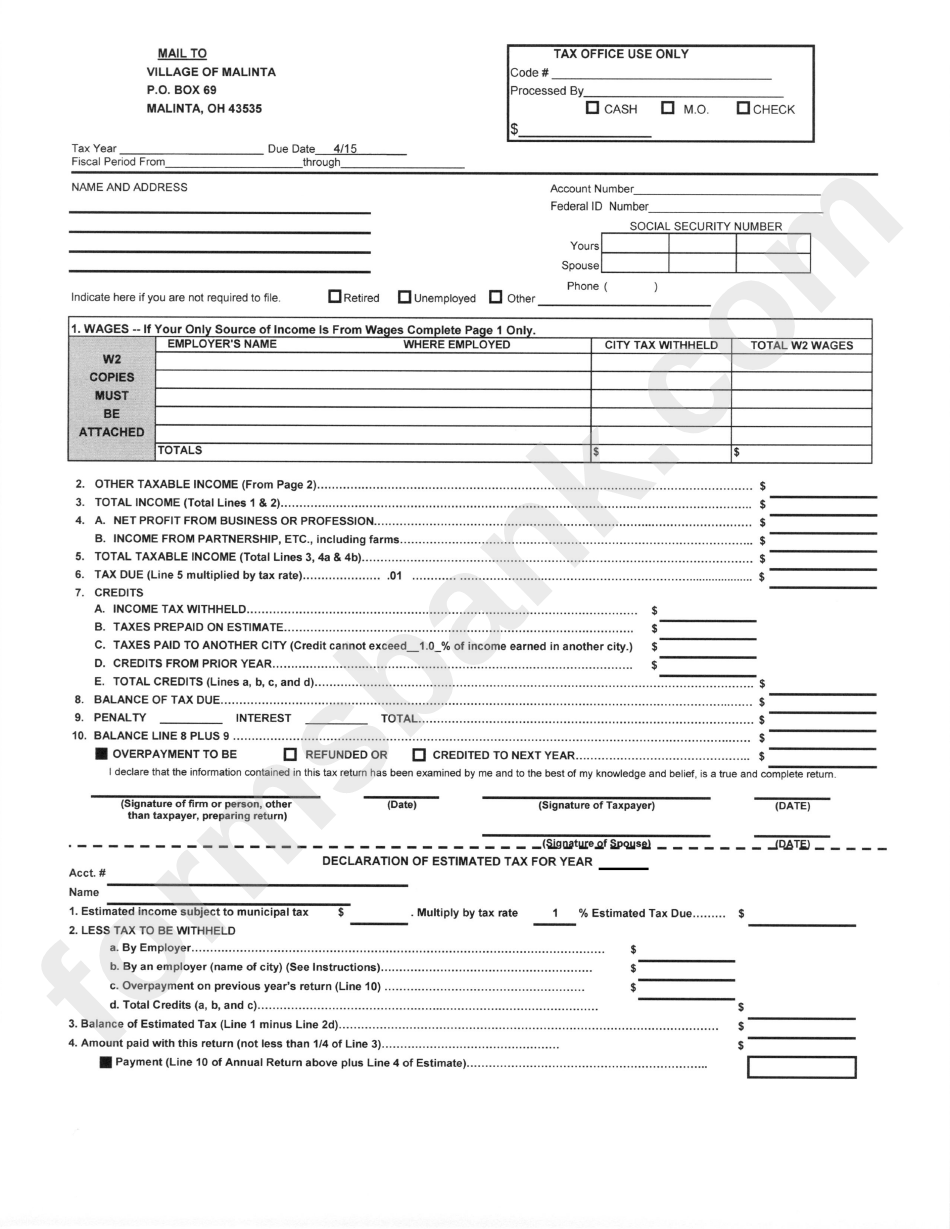

From www.uslegalforms.com

OH Tax Return Bryan City 20182022 Fill and Sign Printable Glendale Ohio Income Tax Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. Ohio is currently in conformity with federal law for tax purposes as. Learn who must file an ohio annual income tax return from the ohio department of taxation. 0%, 2.75%, 3.68% and 3.75%. Ohio’s 2023 income tax latest updates. File. Glendale Ohio Income Tax.

From tessimahala.pages.dev

Ohio Tax Day 2024 Efile Clio Melody Glendale Ohio Income Tax Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. Ohio’s 2023 income tax latest updates. Ohio state income tax brackets depend on taxable income and residency status. Learn who must file an ohio annual income tax return from the ohio department of taxation. Electronic filing options — oh|tax is. Glendale Ohio Income Tax.

From www.pdffiller.com

Fillable Online Village of Glendale, Ohio Cities and Towns in the Glendale Ohio Income Tax Ohio’s 2023 income tax latest updates. Known for its quiet, peaceful living,. The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. Ohio is currently in conformity with federal law for tax purposes as. Glendale is one of only four communities in hamilton county that does not have an. Glendale Ohio Income Tax.

From www.taxpolicycenter.org

Ohio Can Help More Families With Different Tax Cuts Tax Policy Glendale Ohio Income Tax 0%, 2.75%, 3.68% and 3.75%. Ohio’s 2023 income tax latest updates. Ohio is currently in conformity with federal law for tax purposes as. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. File your ohio tax return electronically for free when you use the ohio department of taxation's secure,. Glendale Ohio Income Tax.

From www.uslegalforms.com

AZ Privilege (Sales) Tax Return Glendale 20102022 Fill out Tax Glendale Ohio Income Tax Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. 0%, 2.75%, 3.68% and 3.75%. Known for its quiet, peaceful living,. Ohio’s 2023 income tax latest updates. The state. Glendale Ohio Income Tax.

From www.ideastream.org

Home values in Summit County are up 31. That could mean property tax Glendale Ohio Income Tax Ohio state income tax brackets depend on taxable income and residency status. Ohio’s 2023 income tax latest updates. Glendale is one of only four communities in hamilton county that does not have an income tax. 0%, 2.75%, 3.68% and 3.75%. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Ohio is. Glendale Ohio Income Tax.

From www.myrtleflowershop.com

Places to Visit in Glendale, Ohio Glendale Ohio Income Tax Learn who must file an ohio annual income tax return from the ohio department of taxation. Known for its quiet, peaceful living,. Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. Ohio state income tax brackets depend on taxable income and residency status. Electronic filing options — oh|tax is. Glendale Ohio Income Tax.

From brokeasshome.com

State Of Ohio Employer Tax Tables Glendale Ohio Income Tax Glendale is one of only four communities in hamilton county that does not have an income tax. 0%, 2.75%, 3.68% and 3.75%. Ohio state income tax brackets depend on taxable income and residency status. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Use the finder to find local tax rates. Glendale Ohio Income Tax.

From diaocthongthai.com

Map of Glendale village, Ohio Glendale Ohio Income Tax Ohio’s 2023 income tax latest updates. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. File your ohio tax return electronically for free when you use the ohio department. Glendale Ohio Income Tax.

From www.financestrategists.com

Find the Best Tax Preparation Services in Glendale, CA Glendale Ohio Income Tax Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. Ohio is currently in conformity with federal law for tax purposes as. Learn who must file an ohio annual income tax return from the ohio department of taxation. The ohio department of taxation provides resources to help individual taxpayers understand. Glendale Ohio Income Tax.

From www.taxpolicycenter.org

Ohio Can Help More Families With Different Tax Cuts Tax Policy Glendale Ohio Income Tax The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Ohio. Glendale Ohio Income Tax.

From www.formsbank.com

Privilege (Sales) And Use Tax Return Form City Of Glendale printable Glendale Ohio Income Tax The state has four tax rates: Learn who must file an ohio annual income tax return from the ohio department of taxation. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. 0%, 2.75%, 3.68% and 3.75%. Glendale is one of only four communities in hamilton county that does not. Glendale Ohio Income Tax.

From www.formsbank.com

Sales/use Tax Return City Of Glendale printable pdf download Glendale Ohio Income Tax Ohio’s 2023 income tax latest updates. Ohio is currently in conformity with federal law for tax purposes as. File your ohio tax return electronically for free when you use the ohio department of taxation's secure, online. Ohio state income tax brackets depend on taxable income and residency status. The state has four tax rates: 0%, 2.75%, 3.68% and 3.75%. The. Glendale Ohio Income Tax.

From cf.bank

Locations CFBank Glendale Ohio Income Tax The state has four tax rates: Ohio state income tax brackets depend on taxable income and residency status. Glendale is one of only four communities in hamilton county that does not have an income tax. Learn who must file an ohio annual income tax return from the ohio department of taxation. The ohio department of taxation provides resources to help. Glendale Ohio Income Tax.

From www.formsbank.com

Fillable Privilege Sales And Use Tax Return City Of Glendale Glendale Ohio Income Tax The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. Ohio state income tax brackets depend on taxable income and residency status. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. Known for its quiet, peaceful living,. File. Glendale Ohio Income Tax.

From www.pdffiller.com

Fillable Online Get the free city of new philadelphia ohio tax Glendale Ohio Income Tax Glendale is one of only four communities in hamilton county that does not have an income tax. Ohio’s 2023 income tax latest updates. The ohio department of taxation provides resources to help individual taxpayers understand what they need to do to file and pay. Ohio is currently in conformity with federal law for tax purposes as. Electronic filing options —. Glendale Ohio Income Tax.

From www.pinterest.com

The Role of a Glendale Tax Attorney California’s tax system expects Glendale Ohio Income Tax Use the finder to find local tax rates for sales and use tax, municipal tax, and school district income tax. Electronic filing options — oh|tax is a free, secure electronic portal where you can file returns, make payments, and view. Ohio is currently in conformity with federal law for tax purposes as. Ohio’s 2023 income tax latest updates. File your. Glendale Ohio Income Tax.